1

Neutral

s

Please refer to important disclosures at the end of this report

1

1

Started in 2002, Lemon Tree Hotels Ltd. (LTHL) is India’s largest hotel chain in

the mid-priced hotel sector and the third largest overall, on the basis of

controlling interest in owned and leased rooms. As of January 31, 2018,

Lemon Tree operated 4,697 rooms in 45 hotels (including managed hotels)

across 28 cities in India.

Positives – 1) Emerged as the leading mid-priced hotel chain in a short span

of 14 years, 2) positive hotel industry dynamics with mid priced room demand

expected to grow 11% CAGR ahead of supply till 2022, 3) differentiated

business model in terms of property development ( 65% owned properties),

employee selection specially the inclusion of opportunity deprived Indians,

including differently-abled individuals, 4) well-diversified geographical

location of hotel properties, 5) additions of new hotel properties will help in

sustaining robust revenue growth in future.

Negative-1) LTHL has seen turnaround recently in M9FY2018 after making

losses over the past several years at peaked 75%+ occupancy level which

leaves little room for further improvement in occupancy, 2) it will continue to

incur substantial capex in building up hotel properties for next few years

which would lead to more leverage (IPO is only OFS and no new fresh equity

is issued), 3) Indian hotel industry is becoming extremely competitive with the

advent of likes of OYO rooms and Air BnB which limits company’s pricing

power, 4) low return ratios and promoter’s stake holding.

Outlook & Valuation: It has seen turnaround in M9FY2018 by posting a PAT of

`2.9 cr which was achieved at sort of peaked occupancy and 9% price hike

(taken after September 2017). Hence, any further improvement in margins

have to largely come via price hikes, which looks difficult specially in the

lower range hotels, amid intense competition. At the upper end of the price

band, the EV/EBITDA multiple works out be 44.5x EBITDA of FY2017 and

~38.6x on its FY2018 annualized EBITDA, which appears on the higher side

even when compared to large listed hotel players like Indian Hotels (available

at 33x FY2018 EV/EBITDA, others are available at 20-25x). We recommend

‘Neutral’ on the issue for a mid-to-long term period.

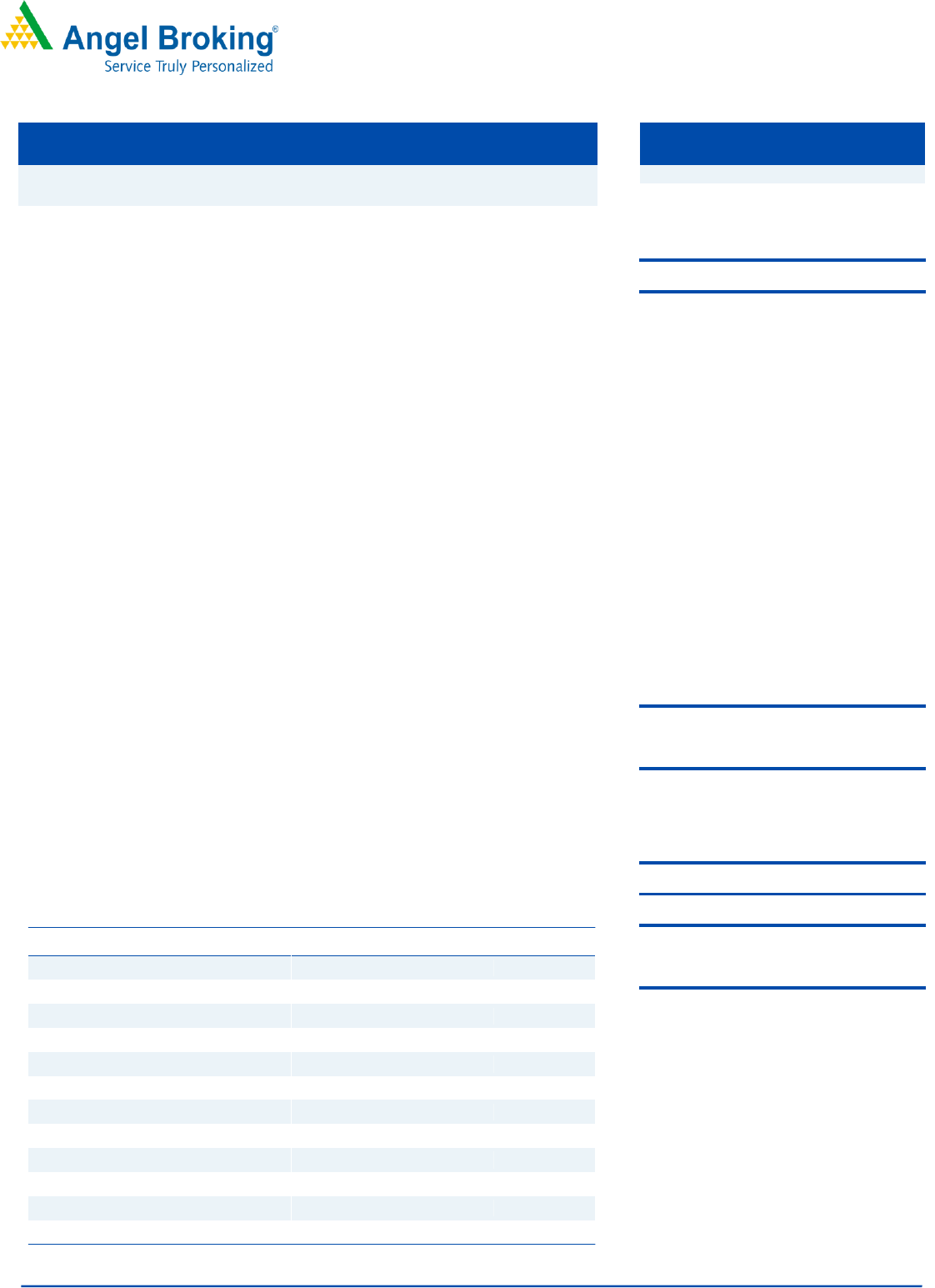

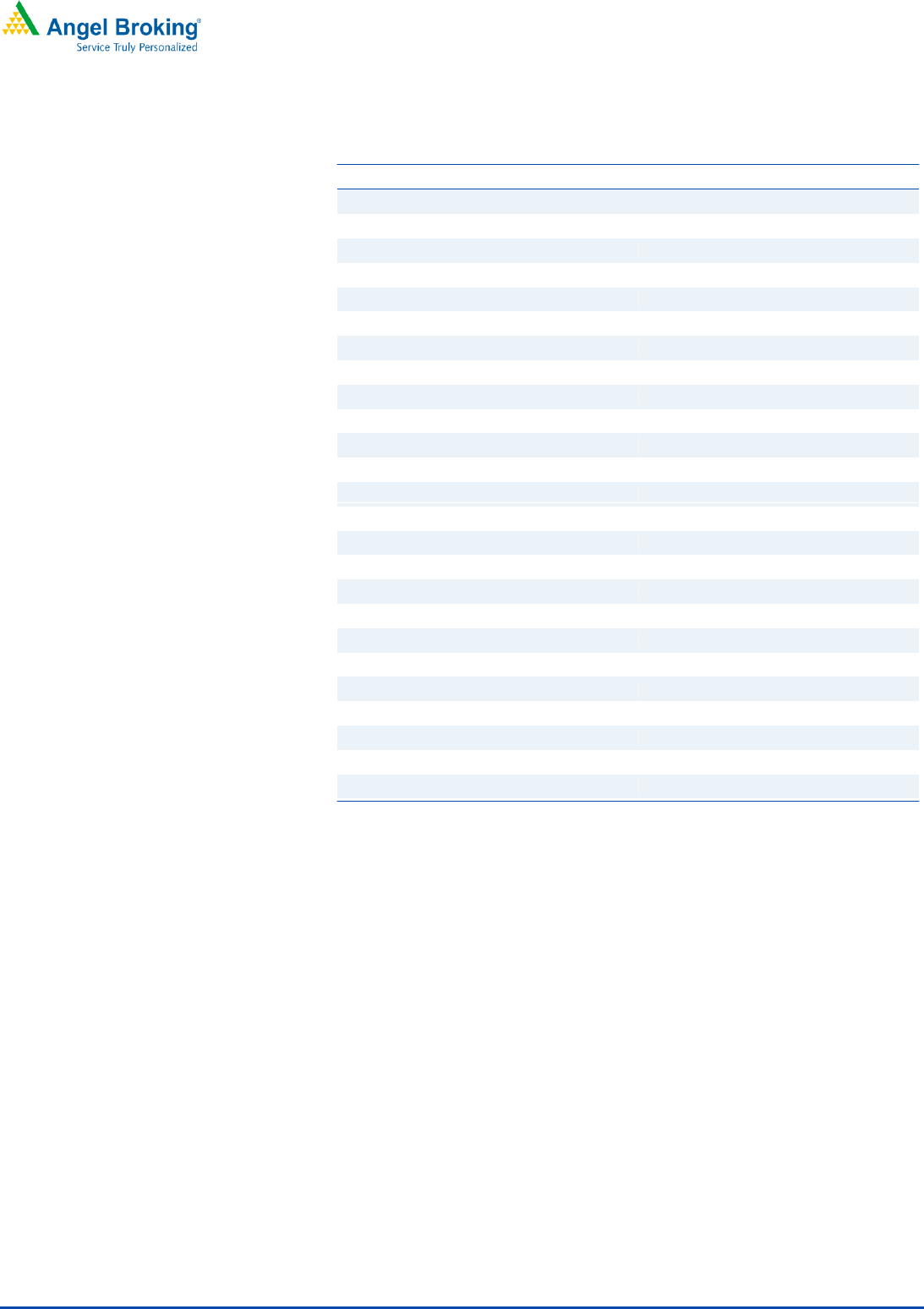

Key Consolidated Financial

Y/E March ( `cr)

FY2014

FY2015

FY2016

FY2017

Net Sales

222

290

368

412

% chg

3.2

31.0

26.7

12.0

Net Profit

(39.1)

(63.0)

(29.6)

(7.2)

% chg

100.2

61.1

(53.0)

(75.7)

OPM (%)

10.5

17.5

27.5

28.2

EPS (Rs)

(0.6)

(0.7)

(0.4)

(0.1)

P/E (x)

(89.7)

(82.9)

(142.1)

(534.1)

P/BV (x)

5.5

5.4

5.4

5.4

RoE (%)

(4.9)

(7.8)

(3.7)

(0.9)

RoCE (%)

(0.6)

(0.1)

3.4

4.1

EV/Sales (x)

21.9

16.9

13.6

12.6

EV/EBITDA (x)

208.0

96.9

49.5

44.5

Source: RHP, Angel Research; Note: * at upper end of the price band

Issue Open: March 26, 2018

Issue Close: March 28, 2018

Book Building

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Post-Issue Shareholding Pattern

Promoters

31%

Others

69%

Promoters holding Pre-Issue: 31.1%

Promoters holding Post-Issue: 31.1%

Fresh issue: Nil

Issue Details

Face Value: `10

Present Eq. Paid up Capital: `786.4cr

Offer for Sale: *18.5 cr shares

Post Eq. Paid up Capital: `786.4cr

Issue size (amount): `1002-1039cr

Price Band: *`54-56

Lot Size: 265 shares and in multiple

thereafter

Post-issue implied mkt. cap: `4247 –

4404 cr

Lemon Tree Hotels Limited

IPO Note | Hotels

March 23, 2018

2

Marc

h 23,

201

Lemon Tree Hotels Limited | IPO Note

March 23, 2018

2

Company background

Founded by Patanjali Govind Keswani in 2002, Lemon Tree operates under three

brands that cater to the needs of different hotel segments—Lemon Tree Premier is

targeted primarily at the upper-midscale hotel segment; Lemon Tree Hotels is

targeted at the midscale hotel segment; and Red Fox by Lemon Tree Hotels is

targeted at the economy hotel segment. As of 31 January 2017, Lemon Tree

operated 4,697 rooms in 45 hotels (including managed hotels) across 28 cities in

India. On the said date, it has 662992 members in loyalty programme as “Lemon

Tree Smiles” and the number is continuously rising. Out of the total rooms, 3,200

rooms are owned, while around 1,500 rooms are managed.

Details of operation

The company offers three brands in three hotel segments:

‘Lemon Tree Premier’ which is targeted primarily at the upper-midscale

hotel segment catering to business and leisure guests who seek to use

hotels at strategic locations and are willing to pay for premium service

and hotel properties;

‘Lemon Tree Hotels’ which is targeted primarily at the midscale hotel

segment catering to business and leisure guests and offers a comfortable,

cost-effective and convenient experience; and

‘Red Fox by Lemon Tree Hotels’ which is targeted primarily at the

economy hotel segment.

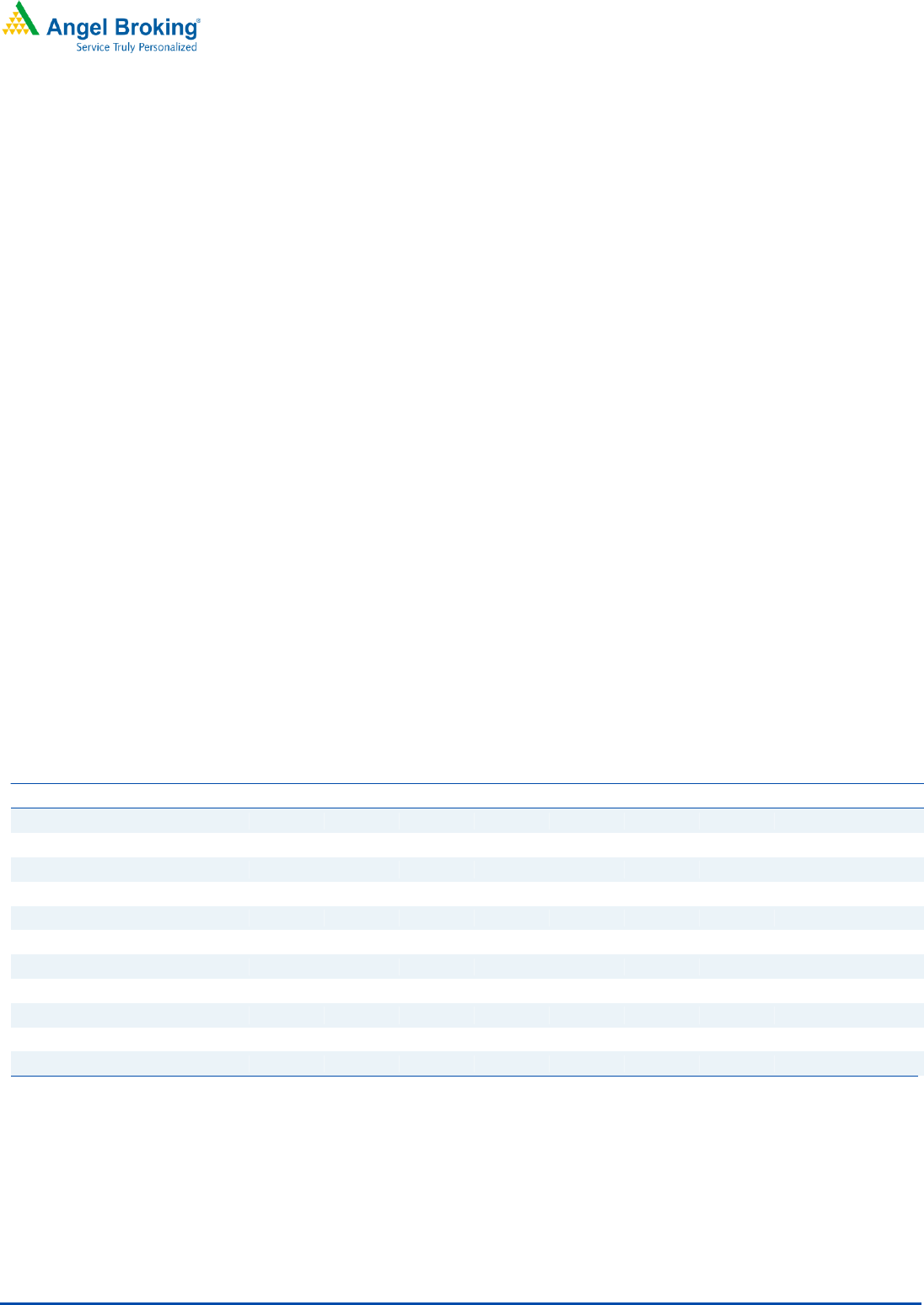

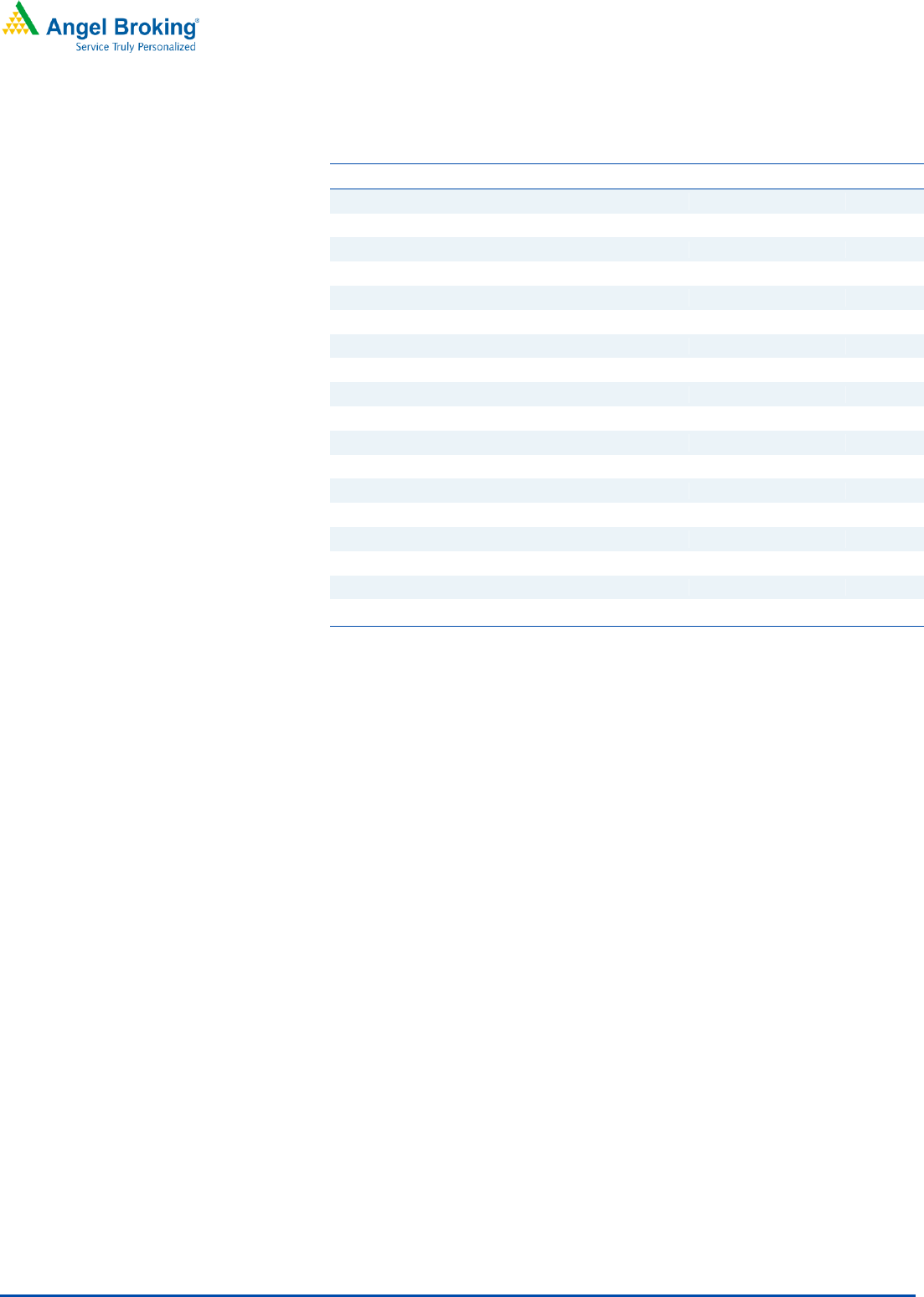

Exhibit 1: Key Operating metrics

Lemon Tree Premier

Lemon Tree Hotels

Red Fox Hotels

2015

2016

2017

2015

2016

2017

2015

2016

2017

No of rooms available

681

877

877

1306

1306

1351

589

605

605

YoY Growth %

28.8%

0.0%

0.0%

3.4%

2.7%

0.0%

No of hotels

4

5

5

13

13

15

4

4

4

Average rooms per hotel

170

175

175

100

100

90

147

151

151

ADR -`

3635

3834

4123

3175

3321

3522

2179

2278

2372

YoY Growth %

5.5%

7.5%

4.6%

6.1%

4.5%

4.1%

Average occupancy

68.30%

78.30%

74.60%

67.90%

73.30%

77.10%

67.80%

75.10%

79.10%

Rev pcc-`

2482

3001

3075

2155

2433

2716

1477

1711

1877

YoY Growth %

20.9%

2.5%

12.9%

11.6%

15.8%

9.7%

Staff per room ratio

0.98

1.15

1.09

1.12

1.15

1.17

0.72

0.75

0.74

Source: Company, Angel Research

1 ADR represents revenue from room rentals divided by total number of room nights sold (including rooms that were available for only a certain portion of

a period).

2 Average occupancy represents the total number of room nights sold divided by the total number of room nights available at a hotel or group of hotels.

3 RevPAR is calculated by multiplying ADR and average occupancy.

4 Staff per room is calculated by dividing total staff at the end of a fiscal year by number of available rooms as of March 31 of each fiscal year.

3

Marc

h 23,

201

Lemon Tree Hotels Limited | IPO Note

March 23, 2018

3

Turnaround posted in M9FY2018 but profitability still low

The company has reported turnaround in M9FY2018 on consolidated basis

after making continuous losses for past several years. However, PAT margins

were still very low at >1% in spite of peaked 75% occupancy level and 9%

price hike in room rentals. Hence, any further improvement in profitability has

to largely come via price hikes, which looks difficult specially in the lower

range hotels. Inspite of registering above industry average margins, the

company’s high debt (DE ratio of 1x in FY2017) and depreciation seems to be

eating its PAT. This phenomenon is likely to continue in coming years as well

due to its aggressive rooms addition plans ( owned rooms to increase by 50%

to over 4500 rooms by 2021).

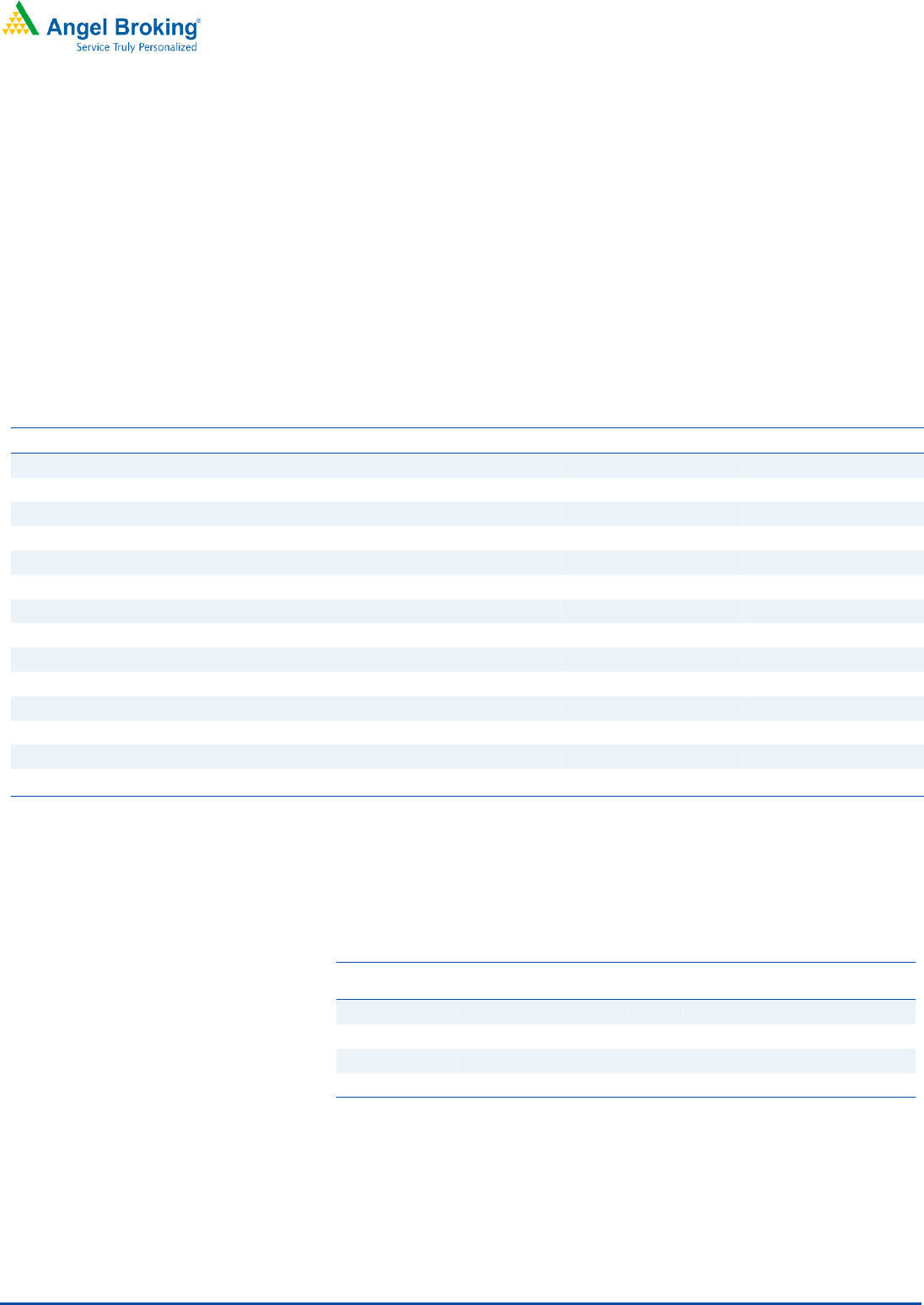

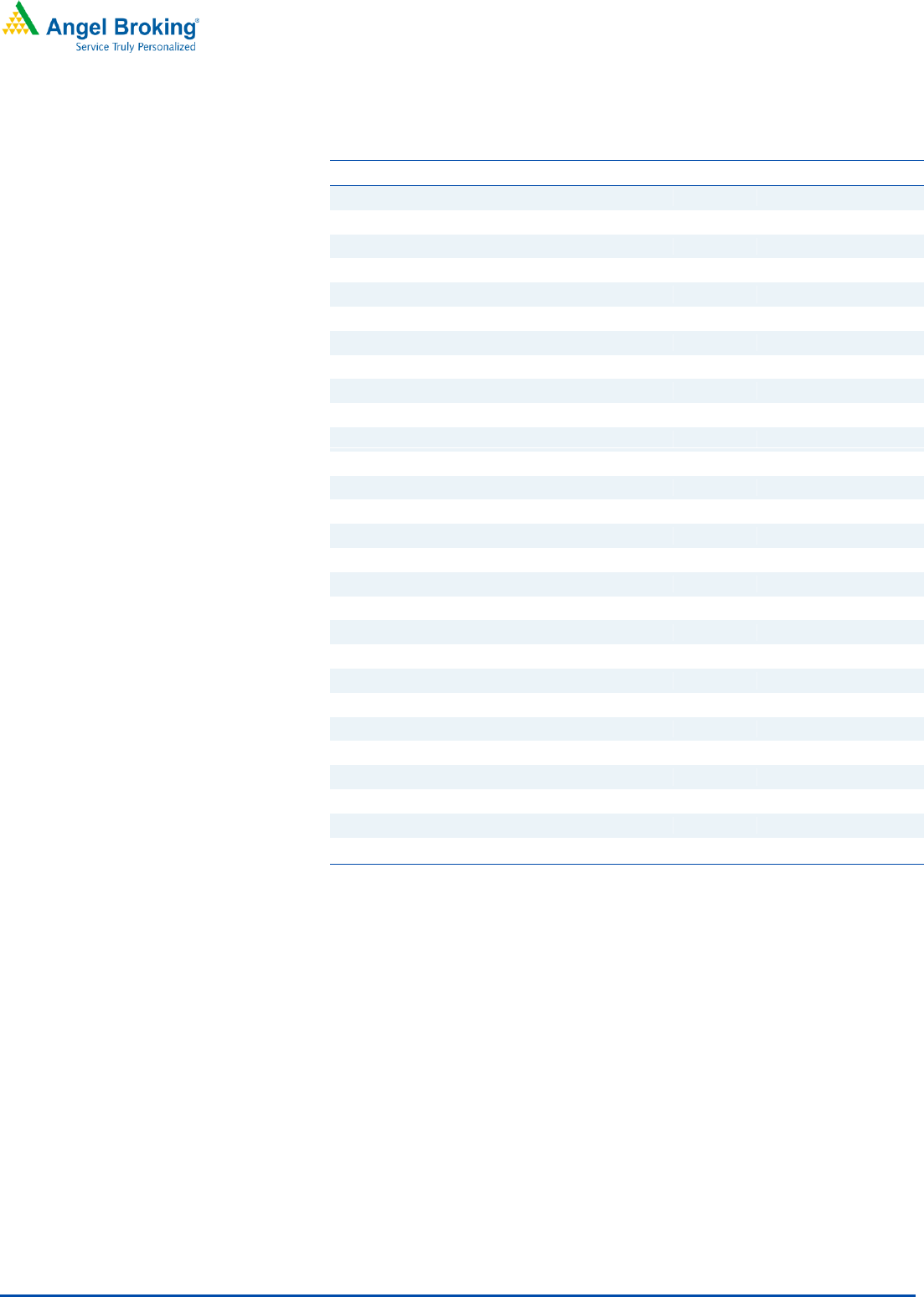

Exhibit 2: M9FY2018 performance

Lemon Tree Premier

Lemon Tree Hotels

Red Fox Hotels

No of rooms available

957

1,477

759

No of hotels

6

16

5

ADR1-`

4,639

3,715

2,777

Average Occupancy

77.0%

74.1%

75.6%

Rev PAR3

3,570

2,752

2,099

Average total hotel revenue per room- `

14,00,405

10,52,410

6,82,514

Revenue from room rental

70.1%

71.5%

82.7%

F&B revenue

20.4%

19.9%

10.4%

Other revenue

9.5%

8.5%

6.9%

Average operating expense / room- `

7,38,609

6,65,001

3,64,162

Operating expenses

52.70%

63.20%

53.40%

Staff per room ratio

1.12

1.18

0.72

Domestic guests

81.2%

84.3%

84.0%

Foreign guests

18.8%

15.7%

16.0%

Source: RHP

Issue Details

This IPO is an offer for sale of up to 18,54,79,400 Equity Shares of face value of

Rs10 each by the Selling Shareholders. Issue would be worth `1002-1039 cr.

OFS is being offered by some of its pre-issue investors and promoters.

Exhibit 3: Pre and post-IPO shareholding pattern

No of shares

(Pre-issue)

%

No of shares

(Post-issue)

%

Promoter

24,43,05,803

31.1%

24,43,05,803

31.1%

Pre IPO Investors

54,21,06,880

68.9%

35,66,27,480

45.3%

Public

18,54,79,400

23.6%

Total

78,64,12,683

100.0%

78,64,12,683

100.0%

Source: RHP, Angel Research

Objects of the offer

This IPO intends to achieve the benefits of listing the equity shares on the stock

exchanges via sale of equity shares by the selling shareholders.

4

Marc

h 23,

201

Lemon Tree Hotels Limited | IPO Note

March 23, 2018

4

Key Management Personnel

Mr. Patanjali Govind Keswani, aged 59 years, is the Chairman and Managing

Director of the Company. He holds a bachelor’s degree in electrical engineering

from the Indian Institute of Technology, New Delhi and a postgraduate diploma

degree in management from the Indian Institute of Management, Calcutta. He has

been on our Board since 2002. Govind Keswani was a Tata Administrative

Services Officer and associated with the Taj Group of hotels for a period of 17

years, including as the senior vice-president (special projects). Mr. Patanjali Govind

Keswani was also associated with A.T. Kearney Limited, New Delhi as its

associated consultant and director. At present, he is also the chairman of the Skill

Council for Persons with Disability and a founding member of the Sector Skill

Council for the Hospitality, Travel and Tourism industry. He has over 30 years of

experience in the hospitality industry.

Mr. Rattan Keswani, aged 57 years, is an executive Director of the Company. He

holds a bachelor’s degree in commerce from DAV College, Panjab University and

a diploma degree in hotel management from Oberoi School of Hotel

Management. He has been on the Board since December 12, 2012. Prior to

joining this Company, Mr. Rattan Keswani acted as the president of the Trident

Hotels of the Oberoi Group, where he was engaged for a period 30 years

Mr. Ravi Kant Jaipuria aged 63 years, is a non-executive Director nominated by RJ

Corp as a Director on its Board. Mr. Ravi Kant Jaipuria has been on our Board

since December 23, 2003 and was last re-appointed with effect from September

30, 2016. He has an established reputation as an entrepreneur and business

leader and is the only Indian to receive PepsiCos International Bottler of the Year

award, which was awarded in 1997. He is a promoter and director of Varun

Beverages Limited and RJ Corp.

Outlook & Valuation

It has seen turnaround in M9FY2018 by posting a PAT of `2.9 cr which was

achieved at sort of peaked occupancy and 9% price hike (taken after September

2017). Hence, any further improvement in margins have to largely come via price

hikes, which looks difficult specially in the lower range hotels, amid intense

competition. At the upper end of the price band, the EV/EBITDA multiple works out

be 44.5x EBITDA of FY2017 and ~38.6x on its FY2018 annualized EBITDA, which

appears on the higher side even when compared to large listed hotel players like

Indian Hotels (available at 33x FY2018 EV/EBITDA, others are available at 20-

25x). We recommend ‘Neutral’ on the issue for a mid-to-long term period.

Key risks

Slowdown in economic growth in India

Since it would affect business and personal discretionary spending levels and

lead to a decrease in demand for hotel services for prolonged periods.

Inability to take price hike amid rise in competitive intensity

5

Marc

h 23,

201

Lemon Tree Hotels Limited | IPO Note

March 23, 2018

5

The hotel industry in India is intensely competitive and LTHL competes with

large multinational and Indian companies, as well as regional and local

companies in each of the regions that it operate.

Any adverse changes in business prospects of its corporate customers

LTHL derives a significant portion (55%+) of its revenue from corporate

customers, and any loss of such customers, the deterioration of their financial

condition or prospects, or a reduction in their demand for its services could

adversely affect its business.

6

Marc

h 23,

201

Lemon Tree Hotels Limited | IPO Note

March 23, 2018

6

Consolidated Income Statement

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

M9FY18

Total operating income

222

290

368

412

352

% chg

3.2

31.0

26.7

12.0

Total Expenditure

198

240

267

296

254

Food, Beverages & Provisions

Consumed

79

96

111

117

Personnel

65

78

85

97

Selling and Administration Expenses

52

63

67

78

Others Expenses

2

3

4

3

EBITDA

23

51

101

116

98

% chg

(37.8)

117.4

99.5

15.0

(% of Net Sales)

10.5

17.5

27.5

28.2

27.8

Depreciation & Amortisation

31

52

52

51

40

EBIT

(8)

(1)

49

ss65

58

% chg

(155.6)

(87.2)

-

33.6

-

(% of Net Sales)

(3.4)

(0.3)

13.3

15.9

16.5

Interest & other Charges

49

72

72

78

54

Other Income

21

13

6

10

1

(% of PBT)

(58.4)

(22.2)

(33.8)

(395.1)

11.8

Share in profit of Associates

-

-

-

-

1

Recurring PBT

(36)

(60)

(17)

(2)

5

% chg

57.9

68.8

(71.3)

(85.7)

Tax

4

3

13

5

2

(% of PBT)

(10.4)

(5.3)

(72.6)

(189.9)

46.1

PAT (reported)

(39)

(63)

(30)

(7)

3

Less: Minority interest (MI)

0

(0)

(0)

(1)

PAT after MI (reported)

(40)

(63)

(30)

(6)

Extraordinary Items

(0)

(0)

(0)

0

ADJ. PAT

(39)

(63)

(30)

(7)

3

% chg

100.2

61.1

(53.0)

(75.7)

(% of Net Sales)

(17.6)

(21.7)

(8.0)

(1.7)

0.8

Fully Diluted EPS (Rs)

(0.6)

(0.7)

(0.4)

(0.1)

0.0

% chg

-

8.2

(41.7)

(73.4)

-

Source: RHP

7

Marc

h 23,

201

Lemon Tree Hotels Limited | IPO Note

March 23, 2018

7

Consolidated Balance Sheet

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

SOURCES OF FUNDS

Equity Share Capital

129

776

778

781

Reserves& Surplus

671

34

32

27

Shareholders’ Funds

799

810

810

809

Minority Interest

290

422

428

428

Equity Share Warrants

-

-

-

-

Total Loans

559

571

625

799

Deferred Tax Liability

11

11

17

23

Total Liabilities

1,658

1,814

1,879

2,058

APPLICATION OF FUNDS

Gross Block

1,287

1,410

1,282

1,518

Less: Acc. Depreciation

122

173

51

100

Net Block

1,164

1,236

1,231

1,418

Capital Work-in-Progress

135

167

259

351

Investments

38

31

6

6

Current Assets

104

64

65

74

Inventories

5

5

5

5

Sundry Debtors

16

18

24

31

Cash

72

30

14

18

Loans & Advances

11

11

21

20

Other Assets

-

-

-

-

Current liabilities

73

82

120

147

Net Current Assets

31

(19)

(55)

(73)

Deferred Tax Asset

(0)

0

(7)

(7)

Total Assets

1,658

1,814

1,879

2,058

Source: RHP

8

Marc

h 23,

201

Lemon Tree Hotels Limited | IPO Note

March 23, 2018

8

Consolidated Cash Flow Statement

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

Profit before tax

(36)

(60)

(17)

(2)

Depreciation

31

52

52

51

Change in Working Capital

0

0

0

0

Interest / Dividend (Net)

41

64

67

70

Direct taxes paid

6

(13)

(12)

(4)

Others

(39)

(93)

(21)

18

Cash Flow from Operations

3

(51)

68

133

(Inc.)/ Dec. in Fixed Assets

(249)

(170)

(132)

(235)

(Inc.)/ Dec. in Investments

144

20

30

6

Cash Flow from Investing

(105)

(150)

(103)

(229)

Issue of Equity

13

12

3

0

Inc./(Dec.) in loans

288

89

82

236

Dividend Paid (Incl. Tax)

38

0

3

0

Interest / Dividend (Net)

45

135

(38)

(74)

Cash Flow from Financing

161

159

19

100

Inc./(Dec.) in Cash

59

(42)

(16)

4

Opening Cash balances

14

72

30

14

Closing Cash balances

72

30

14

18

Source: RHP

9

Marc

h 23,

201

Lemon Tree Hotels Limited | IPO Note

March 23, 2018

9

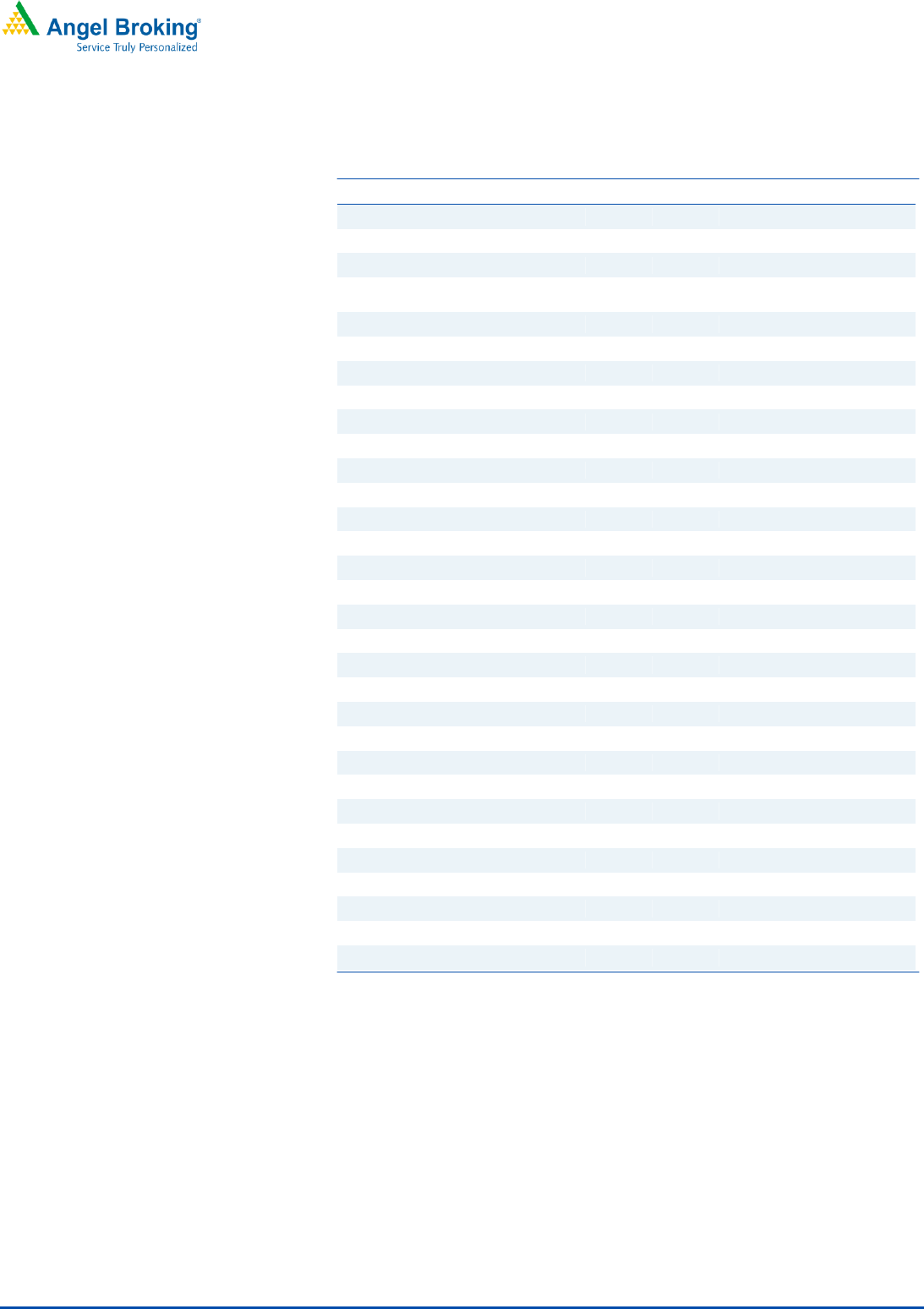

Key Ratios

Y/E March

FY2014

FY2015

FY2016

FY2017

Valuation Ratio (x)

P/E (on FDEPS)

(89.7)

(82.9)

(142.1)

(534.1)

P/CEPS

(528.0)

(381.3)

196.1

100.4

P/BV

5.5

5.4

5.4

5.4

EV/Sales

21.9

16.9

13.6

12.6

EV/EBITDA

208.0

96.9

49.5

44.5

EV / Total Assets

2.9

2.7

2.7

2.5

Per Share Data (Rs)

EPS (fully diluted)

(0.6)

(0.7)

(0.4)

(0.1)

Cash EPS

(0.1)

(0.1)

0.3

0.6

DPS

0.0

0.0

0.0

0.0

Book Value

10.2

10.3

10.3

10.3

Returns (%)

ROCE

(0.6)

(0.1)

3.4

4.1

Angel ROIC (Pre-tax)

(0.6)

(0.1)

3.5

4.1

ROE

(4.9)

(7.8)

(3.7)

(0.9)

Turnover ratios (x)

Asset Turnover (Gross Block)

0.2

0.2

0.3

0.3

Inventory / Sales (days)

8

6

5

4

Receivables (days)

26

23

24

28

Payables (days)

135

114

131

142

Working capital cycle (ex-cash) (days)

(101)

(86)

(101)

(110)

Solvency ratios (x)

Net debt to equity

0.6

0.6

0.7

1.0

Net debt to EBITDA

19.2

10.1

6.0

6.7

Interest Coverage (EBIT / Interest)

(0.2)

(0.0)

0.7

0.8

Source: RHP, Angel Research

10

Marc

h 23,

201

Lemon Tree Hotels Limited | IPO Note

March 23, 2018

10

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.